New Data Indicates Fewer Nevadans Facing Eviction/Foreclosure

Analysis of the Household Pulse Survey data continued to indicate some easing of the high levels of housing insecurity experienced by Nevadans during the course of the coronavirus pandemic.

In an effort to rapidly produce data that records the experience of households during the coronavirus pandemic, the U.S. Census Bureau joined with other federal agencies to produce and publish the experimental Household Pulse Survey data. Each “pulse” is sent out over a two-week period.

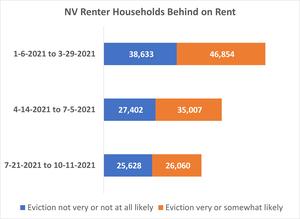

The Census Pulse Public Use Files from the 18 2021 pulses were combined into three three-month periods of six pulses each to increase reliability of the estimates. The three time periods compared were January 6th to March 29th, April 14th to July 5th, and July 21st to October 11th.

In the first three months of the year, an estimated 17 percent of households paying cash rent, or approximately 86,000 Nevada households, were behind on their rent. By the second quarter, only about 13 percent or about 62,000 households were not current. In the last period from July to October, about 10 percent of households said they were behind on rent, or about 52,000 households. The final pulses from July to October asked people in arrears how many months behind they were. The average was 2.4 months.

For households with a mortgage, a similar decreasing trend was observed, although a smaller percentage and number of owner households were having trouble keeping up with mortgage payments. In the January to March period, about 11 percent, or 51,000 households with mortgages, were not current. From mid-April to early July, about 7% or 33,000 households were not current. By mid-July to early October, about 6 percent or 28,000 households were not current with mortgage payments.

This improvement could be because of better employment opportunities as well as success with renter and mortgage assistance programs. Nevada’s unemployment rate decreased from 8.5 percent to 7.3 percent (preliminary) from January to October of 2021. The Nevada Housing Division estimated that nearly 44,000 Nevada households received housing assistance through either the Coronavirus Relief Fund or the Emergency Rental Assistance Fund.

For households that were not current, an additional question was asked about how likely eviction or foreclosure would be in the next two months. For those behind on payments a greater percentage and number of renters were concerned about eviction than were owners concerned about foreclosure. There was an improving trend for both groups over the three time periods. In the most recent of the three time periods, only about 5,000 of the roughly 28,000 owner households behind on mortgage payments felt foreclosure was very or somewhat likely in the next two months, while there were about 26,000 renter households of the roughly 52,000 behind on rent who felt it was somewhat or very likely they would be evicted in the next two months.

Source: Author analysis of the January 6, 2021 to October 11, 2021 Public Use Files of the Census Bureau Household Pulse Survey, Census 2020, 2019 1-year American Community Survey Public Use Microdata, Local Area Unemployment Data at the Bureau of Labor Statistics and Nevada Housing Division testimony to the Interim Finance Committee, Subcommittee to Advise on the Expenditure of Federal Covid-19 Relief Funding, Dec. 2, 2021.

Missing data was not included in denominators in percentages calculated from the Pulse data. Percentages derived from Pulse data were applied to total renter households paying cash rent, estimated at 493,082. The total renter households paying cash rent was derived using Census 2020 total households (1,177,649) times percentage of households paying cash rent derived from 2019 1-year American Community Survey data from the Public Use Microdata Sample (41.9 percent).

Relay Service

Relay Service